He believes companies such as Bikaji Foods, ITC, Britannia Industries, and Nestle are well-positioned to benefit as key input costs stabilise and consumption gradually picks up.

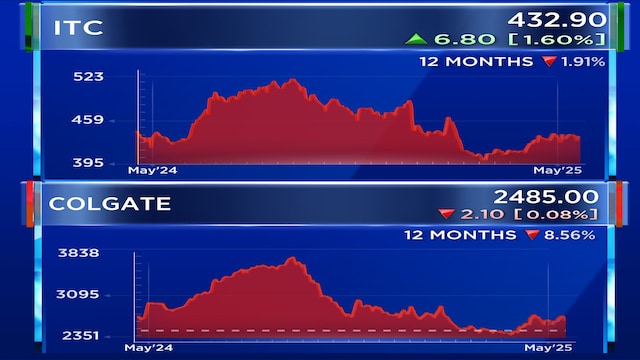

ITC

A nearly 20% drop in palm oil costs should ease margin pressures, especially for food companies that were significantly impacted.

Read Here | ITC results: Q4 net profit soars fourfold, revenue beats street estimates

Recent strategies introduced by Colgate's new Managing Director are also encouraging. Although the company faced a small dip in market share in January-March quarter 2025 (Q4FY25), less severe than some peers, Roy expects conditions to improve from the second quarter this year.

ITC’s shares and Colgate’s shares are currently trading at ₹433.70 and ₹2,489 respectively as of 10:07 am on the NSE

Promotional intensity and a slowdown in urban consumption at the lower end of the market have been major headwinds. However, strong performance in premium products and rural markets suggest that this is a short-term challenge.

Roy anticipates a stronger second half of FY26 for Colgate as competition eases and demand picks up.

Analysts and economists have been worried about the delayed pickup in consumption.

In a recent interaction with CNBC-TV18, Anubhuti Sahay, Head of India Economic Research at Standard Chartered Bank, noted that overall consumer activity indicators have remained flat, with no significant improvement since the December quarter.

Digital payments and ATM withdrawals, key indicators of retail spending, have slowed from an average of 20% growth in the first three quarters of FY25 to 14% in the final quarter. As a result, she does not foresee any major surprises in consumption growth in the near term.

While macro-level consumption data remains tepid, Roy expects selective recovery within the FMCG sector, particularly for companies that have managed costs effectively and are seeing resilient demand in rural and premium segments.

Follow our live blog for more stock market updates